When used responsibly, a credit card can be a useful tool to pay for things you want or need without spending a ton of money all at once. Many stores accept different kinds of credit cards.

But many stores also offer their own credit cards that offer unique rewards when used to purchase items from those stores. That is why Sweetwater has introduced their own credit card as a way of purchasing equipment from them.

But how does their credit card work, how do you qualify for one, and what are the advantages and disadvantages? All this and more will be discussed in this article.

Table of Contents

What is the Sweetwater Credit Card?

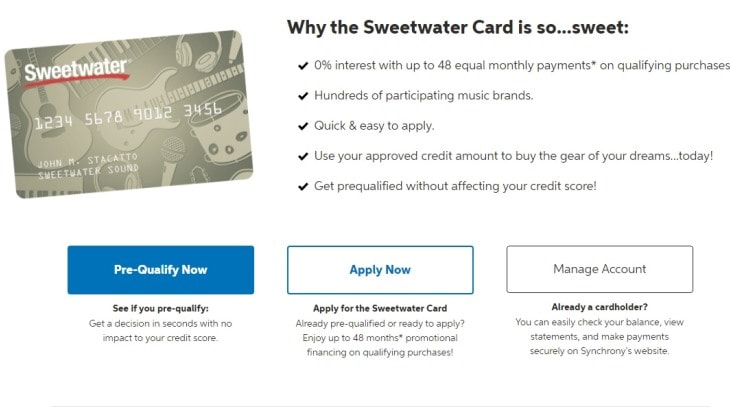

The Sweetwater credit card functions much the same as any other credit card. It is a simple way to buy gear from participating brands and then pay for the items over a certain period.

What sets the Sweetwater credit card apart from a more traditional one is the interest rate. If you buy one of the many qualifying products, your interest rate will be 0% per month, up to 48 months. That means that as long as you are able to pay the product off in 4 years, you won’t be paying a cent extra.

But don’t worry. If an item isn’t on the approved list, you can still purchase items and pay zero interest for up to 6 months. Of course, you can also pay over shorter periods, and these are just the maximum allowed times.

But that does mean that you need to pay a minimum amount within the time limit to qualify for the 0% rate. If you miss a payment or don’t pay the minimum, then the interest rate can go up to 29.99%.

Sweetwater is also not the lender of the credit card. They have instead partnered with Synchrony. Synchrony is one of the largest providers of store cards and is an FDIC-insured online bank.

Sweetwater customers can rest assured that they are protected against data theft, fraudulent activity, and identity theft.

Synchrony also provides dedicated customer support for Sweetwater customers. Any queries or complaints will be resolved by one of their friendly customer support agents.

How Do I Qualify for a Sweetwater Credit Card?

The process for applying is fairly simple and straightforward. If you already have a Sweetwater account then you just need to head over to their Sweetwater Card page. Here you simply need to fill in some basic information such as your Social Security Number, address, and some general financial information.

But how will this affect my credit score? Well, the good news is that Sweetwater also offers a soft credit check. This is done through a pre-qualification check. This lets you know whether or not you are approved before you actually go through the sign-up process.

Speaking of credit scores, the requirement for the Sweetwater card is also usually lower than a bank or a creditor card, at only around 630. However, this isn’t the exact amount and will likely vary from person to person.

To Which Credit Bureaus Does Sweetwater Report?

Sweetwater, or more accurately Synchrony, currently reports to Equifax, Experian, and Transunion.

So, as long as payments are made on time, Sweetwater will report that you show great financial responsibility, which may in turn improve your credit score.

How Much Does It Cost? Are There Any Rewards?

The good news is that there are no sign-up fees and the card isn’t limited to existing customers. There are also no annual fees once you have your card. However, once your card is active, Synchrony may deactivate it if no purchases are made within a certain period or after an extended period of inactivity between purchases.

As for rewards, Sweetwater doesn’t offer any sort of rewards program at the moment. There is no sign-up bonus or cashback program.

Can I Only Use the Card at Sweetwater?

Unfortunately, yes. The Sweetwater card can only be used at Sweetwater. You won’t be able to use it at any other music retailers. You won’t even be able to use it anywhere else that uses Synchrony cards.

Final Thoughts

If you need a piece of gear right now but can’t afford it, or you just prefer paying in installments rather than one big lump sum, then the Sweetwater credit card might be a great option for you.

I wouldn’t consider getting it just to have it, especially if you don’t make regular large purchases.

The lack of rewards is also a bit of a turn-off at the moment. But the card is still rather new and I would keep an eye on it for any major improvements down the line.

The biggest advantage of the Sweetwater card is the 0% interest rate and the flexible payment options.